Dying without a will – the rules of intestacy

If you die without a valid will, your property will be shared out according to certain rules. These are called the rules of intestacy. Here, we explain exactly what that means for you and your family.

When a person dies without a will, this is known as “dying intestate”. Sorting out their estate in these cases can be a little more complicated due to a set of procedures called the rules of intestacy.

Dying without a will can often mean that final wishes are not carried out the way you would like, due to the way the rules are set out. For example, there are no provisions in the rules of intestacy for unmarried partners and non-family members, meaning they will be prevented from claiming any inheritance if there is no will. This is why Percy Hughes & Roberts would urge everyone to have a will written or updated.

If a loved one has died without a valid will in place and you are left a little confused, our experts can guide you through your next steps. The below guide details exactly what the rules are, who can inherit what, and who can apply for probate.

What are the rules of intestacy?

Under the rules of intestacy, only married couples, civil partners, and certain other close relatives can inherit anything from the deceased’s estate. Married couples and civil partners can also only inherit under the rules of intestacy if they are married or in a civil partnership at the time of death.

Partners who have separated informally, through no legal means, can still inherit under the rules. Cohabiting partners who were neither married nor in a civil partnership at the time of death cannot inherit under the rules of intestacy.

If there are any surviving children, grandchildren, or great-grandchildren of the deceased and the estate is valued at more than £270,000, the partner will inherit:

- All the personal items and belongings of the person who has died

- The first £270,000 of the estate, as a legacy

- Half of the remaining estate, known as the residuary estate

To put this into context:

John is married to Sarah, and together they have a son called Billy. John dies without a will. His estate is worth £370,000. Sarah inherits the first £270,000. The estate is then left with £100,000. Sarah and Billy share half of this, £50,000 each.

If there were no surviving children, grandchildren or great-grandchildren in this scenario, Sarah would have inherited:

- All the personal property and belongings of the person who has died, and;

- the whole of the estate, with interest from the date of death.

Who inherits under intestacy?

There is a hierarchy of who inherits the estate if the person who dies was not married or in a civil partnership. In this case, your estate will pass to the following individuals in priority order:

- Your children or grandchildren

- Your parents ⦁ Your siblings of whole blood (or their children)

- Any half-siblings or their children

- Your grandparents

- Your uncles and aunts of whole blood (or their children)

- Your uncles and aunts of half-blood, or their children

- The Crown Legal publication

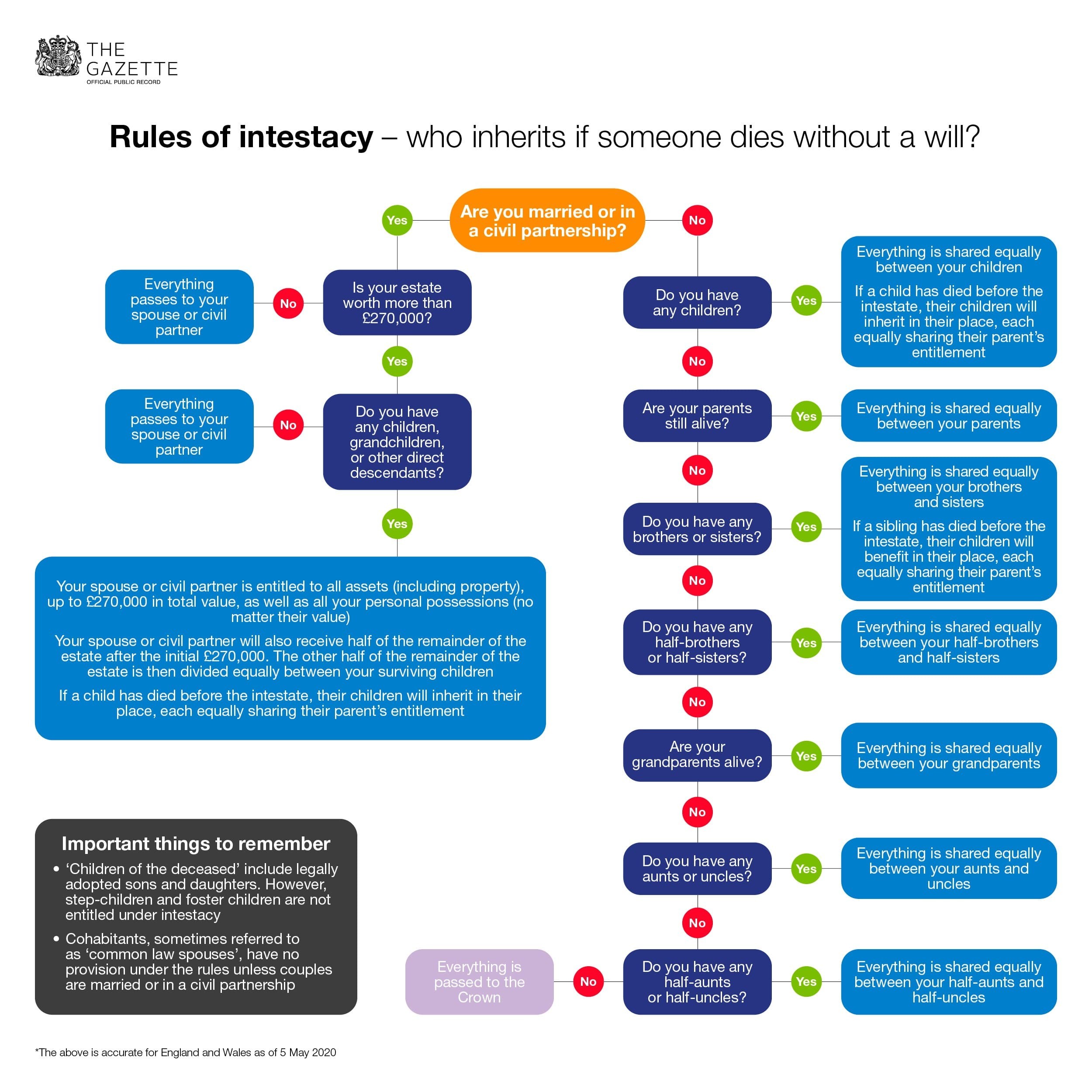

The Gazette has a useful infographic for following this process here (click the image to enlarge)

Who cannot inherit under the rules of intestacy?

Unfortunately, the rules of intestacy do not cater for modern families. There are many people who have no right to inherit anything when someone dies without leaving a valid will. These include:

- Unmarried partners

- Same-sex partners who are not in a civil partnership

- Close friends ⦁ Carers

- Relations by marriage (in-laws)

Are all my assets subject to intestacy rules?

There are also some items that are not subject to the rules of intestacy. These include:

- Property, such as real estate or bank accounts, owned as a joint tenant - this will pass automatically to the surviving joint owner

- A life policy or pension scheme with a nominated beneficiary - this will pass on to a nominated beneficiary

- Life interest held under a trust - this will pass in accordance with the trust

Who can apply for probate when there is no will?

Only certain individuals can apply for probate to deal with the deceased’s estate. If there is no will, a “grant of letters of administration” will have to be applied for. This grant will then make whoever receives it the “administrator” of the estate, which allows them to value the estate, pay any debts and distribute the estate according to the intestacy rules.

You can apply to become the estate’s administrator if you are over the age of 18, and you are the most entitled inheritor of the deceased’s estate. This is usually a married partner, civil partner, or the closest living relative.

If you are the most entitled inheritor but do not want to apply to be the administrator, you can nominate the next most entitled inheritor.

What is partial intestacy?

Partial intestacy occurs when the person who has died did leave a will but, for one reason or another, the will does not fully deal with the whole of the estate.

This might occur when a beneficiary in the will has died during the deceased’s lifetime and no alternative had been made in the will. In this case, intestacy rules will be followed for that part of the estate.

It is also worth noting that this does not make the rest of will invalid. The rest of the estate will still be distributed in accordance with the terms of the will.

Can intestacy rules be challenged?

You are unable to challenge the intestacy rules in the same way you might a will. However, someone who feels that the deceased might have left them some of the estate had they made a will can potentially bring a claim under the Inheritance (Provision for Family and Dependants) Act 1975.

A spouse who was not married, for example, could potentially bring a claim under the Inheritance Act if they are disinherited in favour of the deceased’s children.

There are strict time limits for these challenges, however. A claim must be brought forward within six months of the “Letters of Administration” being granted.

How can we help?

At Percy Hughes & Roberts Solicitors, we have a team of dedicated probate solicitors who are ready to help you resolve your query or issue relating to this area of the law as quickly and effectively as possible.

If you need assistance with obtaining letters of administration, or simply want advice on the intestacy rules, our wills and probate solicitors have a wealth of experience. They can help you through what can be a difficult time, dealing with complex estates.

If you would like to contact one of our expert probate solicitors, you can do so by calling 0151 666 9090 or by completing the “Get in touch” form on this site.

Contact Percy Hughes & Roberts

To speak to an employment law solicitor for advice, contact Percy Hughes & Roberts for a no-obligation phone consultation today. We provide ourselves on offering expert advice that's easy to understand, and we will be with you through every step of the legal process.

Call us on 0151 666 9090, or fill out an online enquiry form to arrange for us to get in touch at a time that's suitable for you.